Table of Contents

1. Best Cases

2. Tax Benefits

3. Americans with Disabilities Act Requirements

4. Other Organizations

Best Cases

At a time when diversity, equity, and inclusion are at the forefront of many companies’ values, it is important to highlight the efforts being made by some organizations to create a more inclusive workplace for people with disabilities. These companies, collectively, create the standard all companies should uphold. It is more than the bare minimum that is outlined in the Americans with Disabilities Act, but truly doing its best to support employees with disabilities.

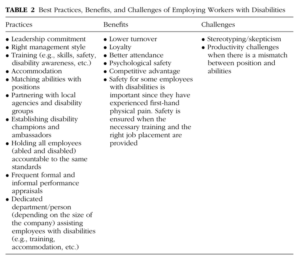

This chart, from Gaining a Competitive Advantage with Disability Inclusion Initiatives (Kalargyrou 2014), outlines some specific best practices outlined by executives, managers, and employees at the Walgreens Distribution Center in Windsor, Connecticut, and the Mohegan Sun Casino in Uncasville, Connecticut.

Table 1:Best Practices, Benefits, and Challenges of Employing Workers with Disabilities

Google’s disability inclusion program focuses on creating an inclusive workplace for individuals with disabilities. The program provides accommodations, support, and resources for employees with disabilities, including assistive technology, accessibility training, and disability-related employee resource groups. In addition, Google collaborates with disability-focused organizations to promote accessibility and inclusion.

Apple is committed to creating an inclusive workplace for people with disabilities. The company already offers a range of accessibility features across its products and services, including VoiceOver, Siri, and closed captioning. More importantly, Apple provides accommodations to enable employees with disabilities to perform their job duties effectively. Apple is a member of The Valuable 500, committing to take action to support disability inclusion in its business agenda to further promote accessibility.

Mathematica offers accommodations and assistive technology to ensure that employees with disabilities can perform their job duties effectively. Mathematica also offers flexible work arrangements to enable employees to balance their work and personal lives. In addition, the company collaborates with disability-focused organizations to promote the recruitment and retention of individuals with disabilities. By prioritizing disability inclusion in its diversity, equity, and inclusion efforts, Mathematica aims to create a workplace culture that values and supports all employees, including those with disabilities.

When it comes to creating an inclusive workplace for people with disabilities, there are several criteria that companies should consider. Like the companies listed above, they should provide

- accommodations for employees with disabilities, such as assistive technology and flexible work arrangements.

- Furthermore, by partnering with disability-focused organizations to promote recruitment and retention, they can ensure that their recruitment and hiring practices are inclusive and accessible.

- These criteria, along with others outlined in the DEI 2022 Report, are essential to creating a workplace that is inclusive of people with disabilities.

An easy-to-use assessment tool has been provided by the US Chamber of Commerce for business to gauge their inclusivity in regard to disability in their “Leading Practices in Disability Inclusion” report. The full document, with even more case studies, can be found here. Additionally, the disability-led nonprofit Mobility International USA has provided a list of questions aimed at organizations looking to improve their inclusion here.

Tax Benefits

Worker Income Tax Credit

Businesses can materially benefit from employing certain persons with disabilities. With the federal Work Opportunity Tax Credit (WOTC), employers can receive tax credits for hiring individuals from one of ten targeted groups, who often struggle with gaining and maintaining employment. These targeted groups include, but are not limited to ex-felons; SNAP, TANF, & SSI recipients; veterans; and those who are referred by vocational rehabilitation programs — disabled individuals who utilize programs designed to aid in their employment goals. New hires must be employed for at least one year before the WOTC can be applied. The tax credit is primarily used against income taxes, and the credit is typically 40% of the qualified wages of employees who work 400+ hours in their first year of employment (about 33 hours per month). State Workforce Agencies are the middlemen who match employers with job programs and facilitate the WOTC application process as well. More information can be found on the IRS here and the Department of Labor’s website here.

Disabled Access Credit

The Disabled Access Credit is for small businesses that incur expenses in providing access to those with disabilities, including employees. Businesses with less than 30 full-time employees who make less than $1,000,000 per year can get this benefit every year they have these expenses. More information can be found from the IRS here.

Americans with Disabilities Act Requirements

The Americans with Disabilities Act, or ADA, prohibits an employer from retaliating against an applicant or employee for asserting his rights under the ADA. The Act also makes it unlawful to discriminate against an applicant or employee, whether disabled or not, because of the individual’s family, business, social or other relationship or association with an individual with a disability.

The ADA makes it unlawful to discriminate in all employment practices such as:

-

- recruitment

- pay

- hiring

- firing

- promotion

- job assignments

- training

- leave

- lay-offs

- benefits

Additionally, the ADA outlines the necessity of what it calls “reasonable accommodations”, defined as “a modification or adjustment to a job, the work environment, or the way things are usually done during the hiring process.” These accommodations allow individuals with disabilities to apply for positions, perform the vital functions of their job, and enjoy the benefits that employment can bring. Some examples of reasonable accommodations are installing screenreader software on work computers, installing ramps at entryways, and allowing individuals to modify their work schedule to attend regular medical appointments. Accommodations are tailored to each individual, their needs, and their work setting. More information about the ADA (including reasonable accommodations) can be found on the ADA website here, and an “ADA Library” provided by the Job Accommodation Network (more below) can be found here.

Other Organizations

Some organizations that help businesses hire and support their disabled employees include:

- The Job Accommodation Network (JAN) is the premier source for guidance on job accommodations and disability employment. They are funded by the Office of Disability Employment Policy, under the Department of Labor. Their services are free & confidential, and they consult one-on-one with employers, individuals with disabilities, legal representatives, and federal & state bodies. Topics include ADA regulations, specific accommodations recommendations, tips for inclusion in the workplace, example scenarios and solutions, specific disabilities & symptoms, and more. Their Frequently Asked Questions page can be found here and their YouTube channel, featuring various learning modules, can be found here.

- The What Can You Do Campaign promotes the employment of individuals with disabilities. They give step-by-step information for businesses in various ways, like connecting with local organizations & vocational rehabilitation groups, creating an inclusive workplace, and assisting them with job accommodations.

- Easterseals is an advocacy & support organization for people with disabilities. They offer job training for individuals, encourage businesses to hire disabled individuals, and provide guidance to employers throughout the process.