Through our interviews with structured questions, we collected some insightful quotes that may bring even more understanding to the issues of Child Tax Credits.

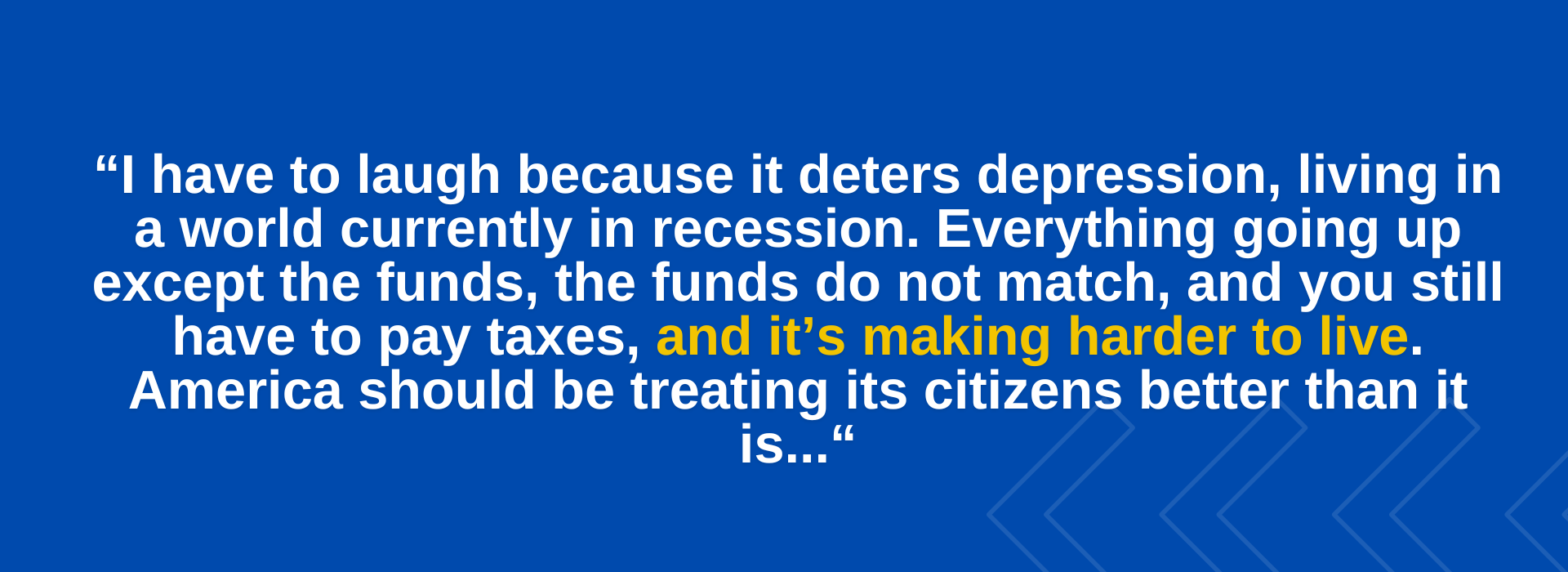

A quote from a participant after the interview, lamenting the current economy.

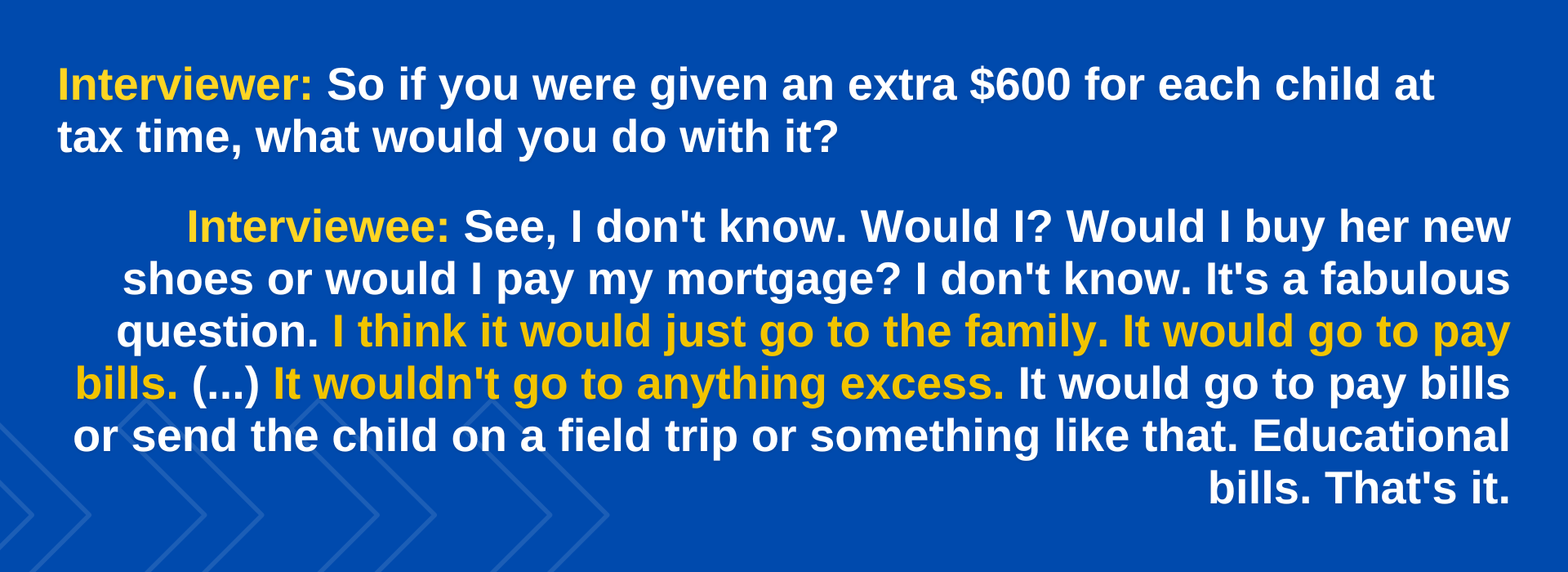

A quote from a participant after being asked how they would spend an extra $600 at Tax Time

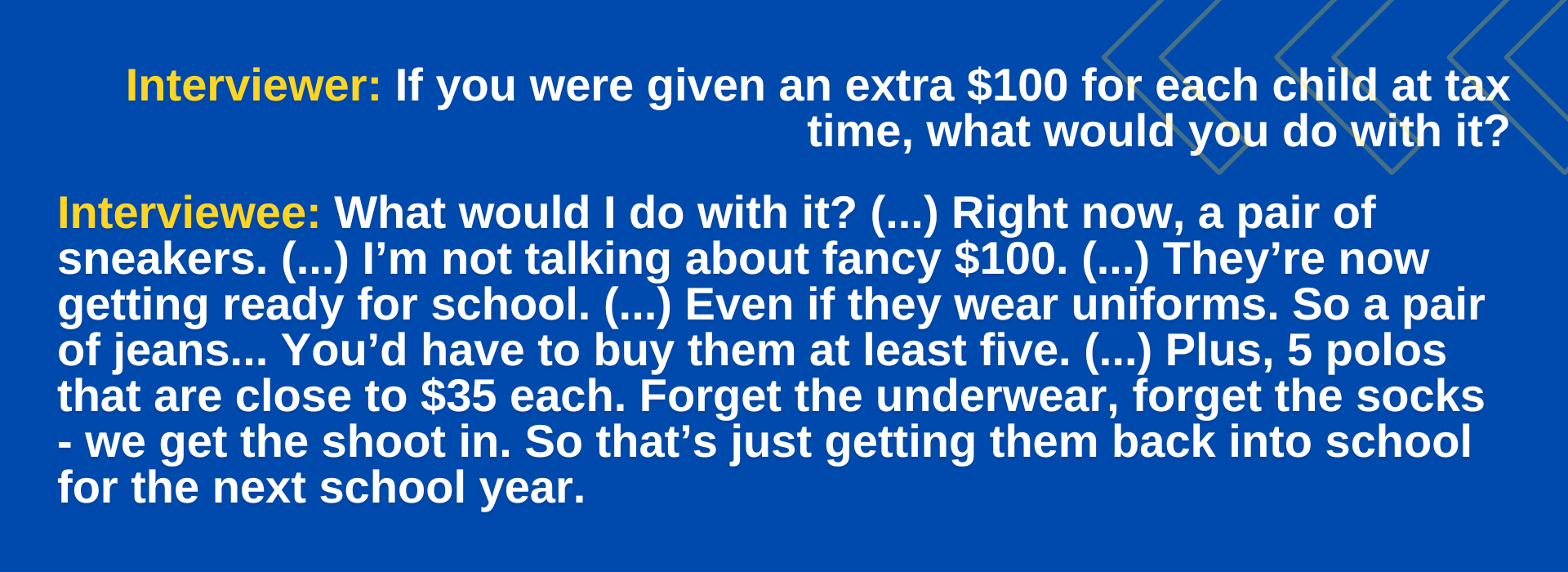

One participant talks about how they do not desire luxury items, but are just looking to afford the basics.

One participant talks about how they do not desire luxury items, but are just looking to afford the basics.