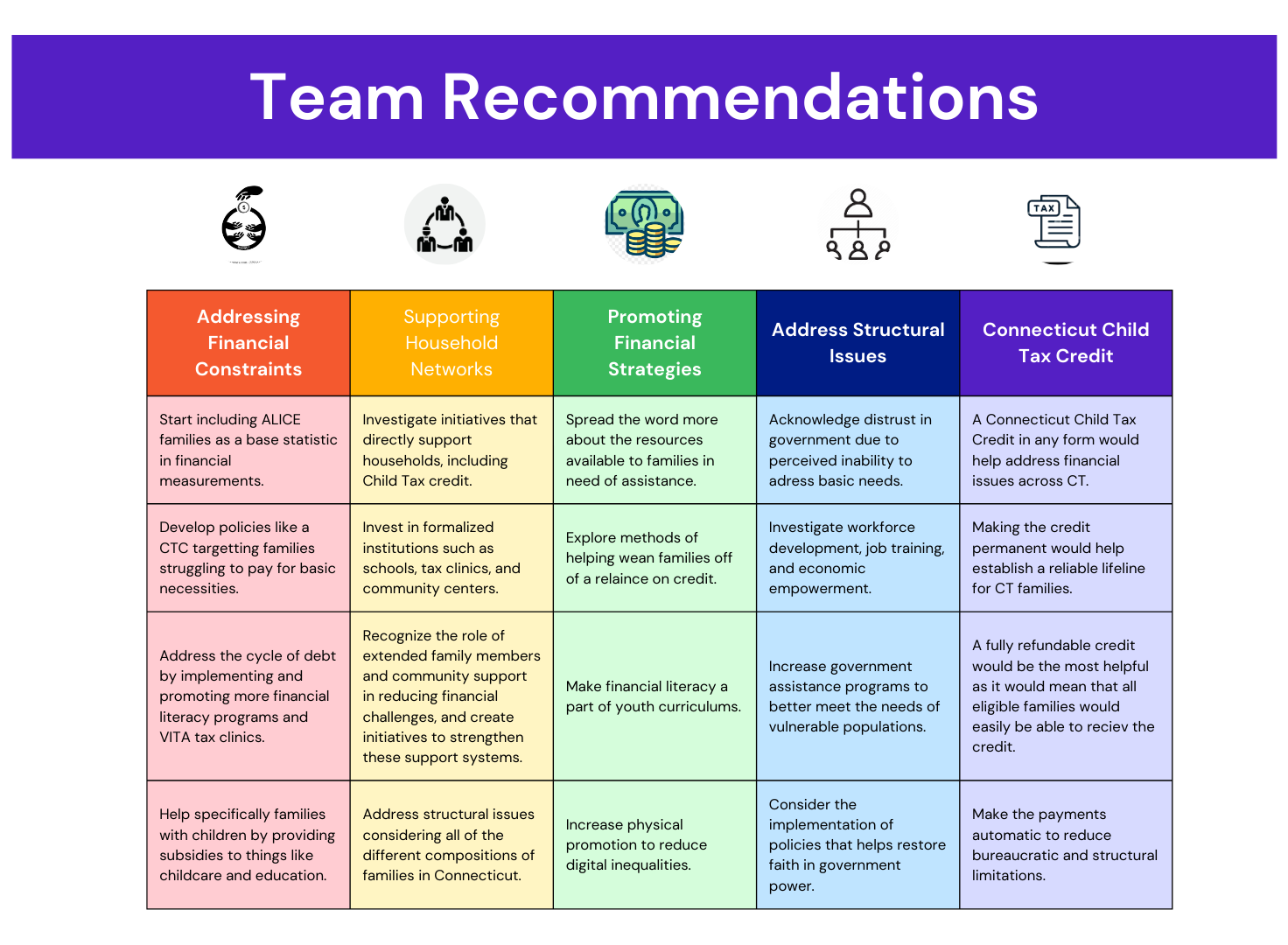

The direction from our community partner was to interview families about their opinions on a CT CTC, but our findings led to more recommendations than just the tax credit.

- According to our findings, a Child Tax Credit expansion in any of its forms would be helpful – whether it is provided to families as a lump sum -as in the American Rescue Plan- or through monthly payments. The support for the expansion was unanimous. We recommend a probe within the Greater Hartford area and its residents to determine what the population’s preferred method of receiving the CTC would be.

As it has been already recommended by United Way in their “CT CTC: A Permanent Solution Supporting Connecticut Families to Make Ends Meet” report, regarding the implementation of the Child Tax Credit Extension, we suggest:

- Establishing a permanent credit.

- Making the Connecticut CTC fully refundable.

- Automating payments (to reduce bureaucratic and structural limitations)

- Expanding access to the CTC.

Families are built within different compositions, and recognizing the diversity in their types is imperative. That being said, their structures are not an issue, yet the obstacles they face are. Recognizing that there are intersectional hurdles that might prevent families from helping their members access processes and resources is also necessary to provide suggestions to support household networks.

- Along with investment in formalized institutions, we recommend investing in initiatives that directly supports households, including but not limited to the Child Tax Credit. Research has shown the importance of a safe household –economically, physically, and socially– for child development. Families know better the needs of their members, and helping them can make a more substantial impact. It is essential to consider the support (or creation) of other alternatives that provide specialized attention to the diversity in family composition. Based on our research results, we were able to appreciate the different types of household structures, and we acknowledge that depending on their composition, some obstacles might also be encountered. We encourage to address the structural issues that they face!

- Recognize the role of extended family members and community support in mitigating financial challenges, and foster initiatives that strengthen these support systems.

- Support the development and maintenance of strong community networks to provide financial assistance and resources. For instance, increase promotion for community resources (for example, food pantries) and make them more accessible. This would help to reduce food insecurity – a factor that limits development in other arenas- in food desert areas as high-value food pantries often maintain a strong community network by maintaining high-quality food and culturally affirming products.

- Explore ways to reduce reliance on credit and alleviate debt burdens, particularly during critical times such as tax season.

- Public education programs should edit curriculums to make financial literacy courses more available to young children so this can translate to valuable financial management strategies as adults. These should be available in different languages given Hartford’s linguistic diversity. Some of the languages could be Spanish, Portuguese, and Creole.

- Emphasize and increase advocacy and publicity through physical appearances to reach a broader audience and to reduce digital inequalities.

- Acknowledge the erosion of trust in government institutions due to perceived inadequacies in addressing basic needs. To start, offer more housing programs to increase the level of households with dependents so they can either afford homes or pay their rent.

- Address concerns regarding financial mobility and opportunities by investing in workforce development, job training programs, and economic empowerment initiatives. Similarly, we recommend making existing job training programs more accessible and appealing by considering the specific age cohorts that people are a part of, and by providing more incentives, respectively.

- Enhance government assistance programs to better meet the needs of vulnerable populations and ensure that individuals feel supported and appreciated by the institutions meant to serve them. At a greater Hartford level, a special focus could be given to those who have lived for a prolonged period in the city.

- Consider the implementation of policies that restore dignity and faith in the system, such as the proposed Connecticut Child Tax Credit, which has shown potential to lift families out of poverty and provide much-needed financial relief.

- United Way proposes the ALICE (Asset Limited, Income Constrained, Employed) data-driven model as a mechanism to understand intersectional layers affecting the socioeconomic statuses of families. We recommend recognizing the significance of the threshold to understand financial struggles. The average income of participants falls below these thresholds, indicating widespread financial instability.

- Develop targeted policies to alleviate financial burdens, particularly focusing on housing affordability, food security, and utilities. Prioritize initiatives that directly address the needs of individuals struggling to cover basic expenses and make bill deferment programs more available and accessible to those who struggle with making basic payments.

- Implement measures to address the cycle of debt, including financial literacy programs and regulations on lending practices to prevent predatory borrowing.

- Provide support for families facing the financial pressures associated with child development, such as childcare subsidies and educational assistance.