After conducting research in the Upper Albany & Behind The Rocks neighborhoods, we concluded that the main reasons why Hartford’s homeownership rate is so low is because:

- Hartford is Unaffordable

- Housing Stock is Limited

- Credit is a High Barrier for Residents

- High Desirability to Own a Home

- Location: Some want to stay, some want to leave

Hartford is Unaffordable

The home ownership rate in Hartford is so low because there isn’t enough housing available for residents that matches with their price range.

The median household income in Hartford is $32,163 and the median value of a home in Hartford is $157,499. This gives Hartford an overall average PTI of 4.90. As a comparison, West Hartford, an affluent suburb directly next to Hartford, has a median household income of $91,875 and a median home value of $318,800, coming to a PTI ratio of 3.47.

By looking at the bar chart, only Downtown is considered affordable. However, if we look at the national average in 2017, which was 4.2, then only 6 out of the 16 neighborhoods have better than average Price to Income Ratios.

The general rule of thumb is that homebuyers should get a house that is worth no greater than 2.6 times their income. By looking at the bar chart, only Downtown is considered affordable. Lack of affordability is a crucial finding and theme we found through our research.

Looking at this table, we can see how huge the gap between the income and house value within each neighborhood is. For example, the West End neighborhood has the highest median home value. In this neighborhood the median home value is $333,000, more than double the citywide median home value. Contrary to popular belief, the median income in the West End neighborhood is $38,068, much lower than in other areas of the city. These statistics show us that incomes in Hartford are too low while home values are too high, thus making most of the city unaffordable.

Housing Stock is Limited

Single family homes are more heavily distributed on the outskirts of Hartford near surrounding suburbs. This is important because when we asked residents of Hartford about their desire to buy a house, we found that the most popular reasons why residents want to buy is to have their own space and privacy.

When we looked at Hartford assessor property Information data, we found out that 66% of housing in Hartford is composed of multi-family residences and condos, and only 34% of housing in Hartford are single-family homes. However, 70% of the single-family homes are owner-occupied. This matters because of the relationship between housing stock and home owner occupancy, which is further explained in the section on Housing Stock and Owner Occupancy.

We also interviewed a few real estate agents to get their view on homeownership in Hartford, and most mentioned housing stock being an issue.

A locally respected and well-established real estate agent noticed that there is a lack of proper housing stock. This agent also said that the lack of sufficient increases in the housing market and stalled home values are major market trends affecting Hartford’s lacking homeownership.

A representative from another local real estate company said that the current housing stock is also really old. Although it is a positive to have large, beautiful, and historic homes in Hartford, those types of houses almost always accompany additional home inspections and touch-ups. Oftentimes people don’t take into consideration how much time and money will have to be devoted to repairing something like a front porch or balcony, which several homes in the city have.

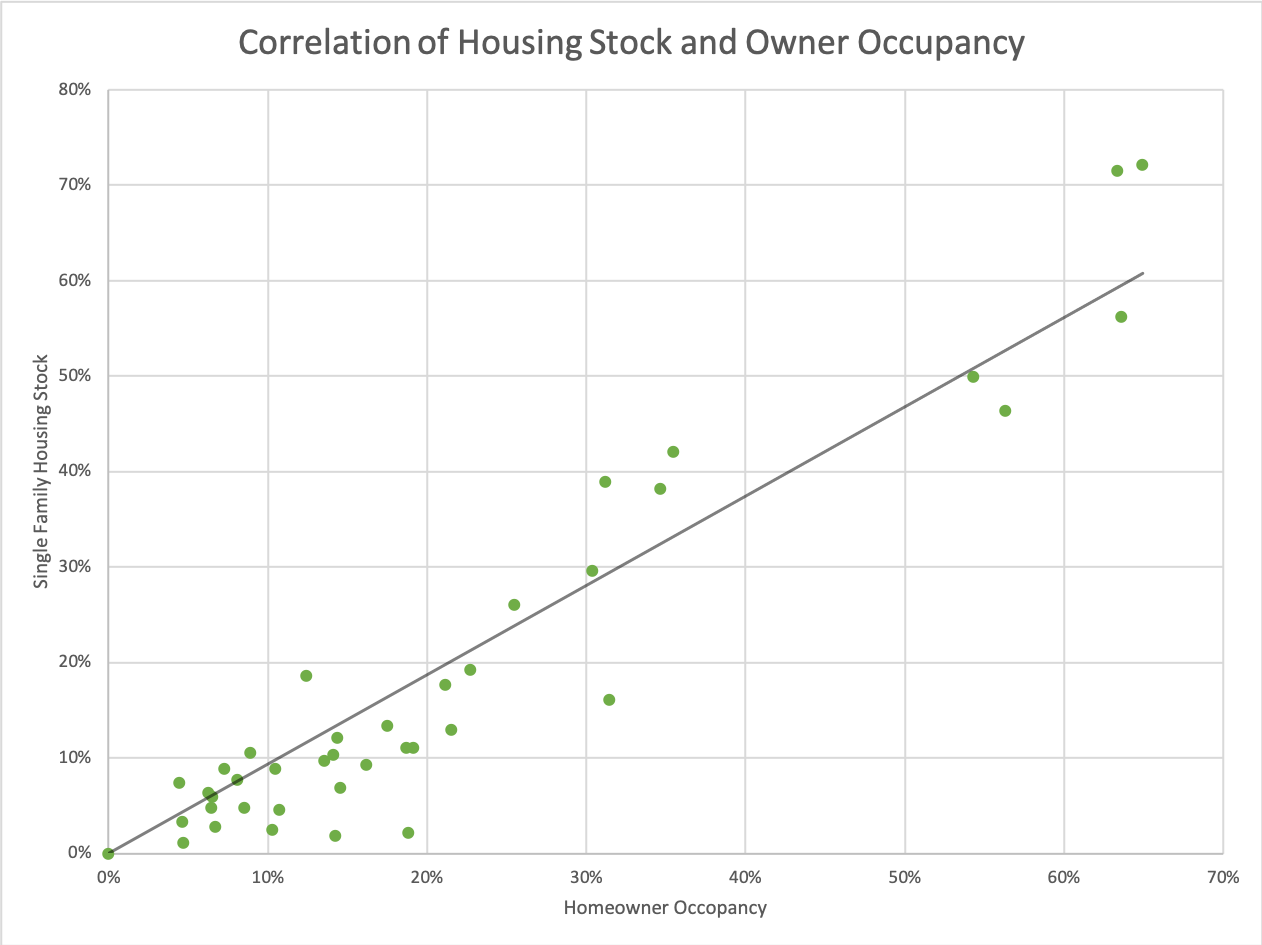

Based on our interviews with realtors, we wanted to look at the relationship between housing stock and homeowner occupancy.

Data from the census track on Social Explorer

Based on the graph above, there is a strong correlation between housing stock and owner occupancy. As the number of single-family homes increases, so does homeowner occupancy. This means that the more single family homes there is in a specific area, the greater the chance that the houses would be occupied by the owners instead of by renters.

Credit is A High Barrier for Residents

When meeting and talking with residents in our two selected neighborhoods we found that credit was a major issue for many people. Many residents either knew that they had bad credit or were not sure what their credit was at all. Regardless of how it was mentioned, the dialogue around this issue became a trend very early on in the interviewing process and continued to be discussed until we finished. Of the 30 residents that we talked to, 19 (63.3%) mentioned that credit was a barrier standing in the way of them buying a home.

While interviewing a woman from the Behind The Rocks neighborhood, she mentioned credit to us before we reached the credit survey question. She discussed how prevalent poor credit was in the neighborhood and that she is currently renting so that she can work on building her credit. This resident later elaborated on this issue when we asked her if there was anything she wished she knew more about in regards to buying a home. She told us,

"Schools need to prepare kids early when it comes to handling money. I wish I knew certain things like how many credit cards I can have and what is good vs. bad credit and what are the steps people can take to try and get their credit score higher.”

On top of this, many residents feel overwhelmed regarding the credit-boosting process. In the Upper Albany neighborhood, one resident said,

“I checked my credit last week and they said I need a credit consultant and I was like no I am not going to do that”.

She proceeded to tell us that she does not have the time or the confidence to meet with a credit consultant in order to truly solve the problem. Yes, credit scores are certainly issues for people in Hartford, but the deeper underlying problem is fixing those credit issues. The process required to fix credit issues is simply not attractive or accessible to residents of Hartford.

After conducting all interviews, it was clear to us that a significant portion of Hartford residents have poor credit, are renting because they have poor credit, and are trying to improve their credit so that they can eventually buy a home.

High Desirability to Own a Home

Out of the 30 residents we interviewed within Behind The Rocks and Upper Albany, 27 stated they would like to buy a home. While this is interesting, we were interested in WHY this was. After analyzing our responses from our interviews, we came across some key findings:

- Stability

- American Dream

- Potential to Make a Difference

- Not My Top Priority

Below are some personal stories that stood out to us regarding this question.

“Owning a home would give me stability”

By talking to residents we found that owning a home promotes financial stability and well-being while also being a place in which people (and families) can feel grounded and comfortable.

One woman we talked to in the McDonald’s on Albany Avenue gave us real insight into why she wanted to own a home. She is a single mom with two kids who noted that, when the time was right, she “eventually wants to own a home for stability”. She continued to say,

“You’re your own landlord. You get to pick and choose what you do with your home and your choice to stay or leave. When you’re renting your under lease so it’s only a short period of time”

This also supports the claim that renters do not feel stable and grounded in their homes. It always seems to be a temporary fix, and she told us she wishes she could provide a home for her family.

As shown in this story, owning a home serves as a stable environment to raise a family. However, owning a home also provides a place that people can feel grounded and comfortable in. Since most of our interviews were with renters, we saw that, because their home wasn’t really theirs, they did not have access to a place they could proudly call ‘home’.

“It’s the American Dream”

Many residents responded to our question of ‘why do you want to own a home?’ with

“It’s the American Dream. That’s what you do.”

In addition to providing stability, we found that resident’s also wanted to own a home because they felt that it was a key part of achieving the “American Dream”. Owning a home gives security and is tied to a feeling that you are achieving the American ethos. Having a place of your own is an accomplishment and, in some ways, signals stability. Based on the statistics of desirability to own a home and some of the common themes that emerged from our interviews, it is clear that owning a home is about more than just ownership. It is about feeling grounded, proud, and valuable within society.

“Potential To Make A Difference”

One interview that really struck us was with a middle aged woman who expressed her interest in becoming a landlord. She referred to her landlord as a “slumlord”, and criticized their lack of effort to maintain her home. Her children grew up with mold growing and rats running around their home.

“Because unfortunately a lot of these landlords, instead of being landlords they are slumlords. They want to live in Bloomfield and West Hartford, Avon, and we live out here and they don’t want to fix anything. And you call them to tell them you have mice in your house, you have to call them a million times, and they come down and give you a rat trap and then go right back up to Avon”.

Ultimately, she wanted to own a home and be a landlord so that other people do not have to experience what her family has been through. This was the only resident that we talked to who expressed such selflessness. Other residents expressed the collective struggle of the neighborhood, but this woman was the only interviewee who wanted to become a pure-hearted landlord.

“Maybe. But it’s not my top priority”

In addition to responses regarding a lack of adequate funds or sufficient credit, some residents were too busy with other responsibilities in order to purchase a home. One resident of the Upper Albany neighborhood noted that her life was just too busy to be researching about the home buying process;

"If you are not working two or three jobs, the economy around here grows without your paycheck growing"

This resident is primarily focused on maintaining a living with the many jobs that she has. Her main priority is making her rent payments, not on potentially buying a home. These findings reminded us that there is a sense of privilege to buying a home. Having the time, resources, social stability, and financial stability to be able to buy a home is not common, especially for people who take multiple jobs just to stay afloat.

On the other hand, a few residents stated that they don’t want to buy a home because they don’t have a family and therefore don’t require excessive space at the time. One interview participant opened up to project members regarding how his current family dynamic has left him interested in purchasing a home. During the interview the man said

"My wife and I divorced a few years ago which is why I am living in a condo. I don’t want to buy a home because I got other expenses that need to be paid for. Child care for my son is my priority right now not getting out of the condo that I’m in.”

These interview components reflect the idea that not all residents in Hartford are looking to purchase a home right now. They might have a distant goal of purchasing, but they are preoccupied with the current responsibilities in their lives. Despite less formulated ownership goals or plans, these residents still expressed a lack of knowledge about the home-buying process.

Location: Some want to stay, Some want to leave

Another theme that we found through the interviews emerged when we asked “If you bought a home, where would you buy?” some residents stated they wanted to remain in Hartford, while others wanted to leave. Below is a breakdown of the results we gathered after asking that particular question.

8/30 stated that they would like to buy a home in the South End/ Behind The Rocks

7/30 stated that they would like to buy a home in the North End/ Upper Albany area

10/30 stated that they would like to buy a home in the suburbs close to Hartford

5/30 stated that they would like to buy a home out of state

The amount of residents who told us they would like to stay in Hartford pleasantly surprised our team. The main reason for people wanting to stay was because Hartford is their home, and they want to remain in the place that they love. Some said they were just familiar with it, while others told us about maintaining family roots and lineages within their particular neighborhood.

One conversation we had gave us insight on why people may want to leave Hartford. When we asked her where she would potentially buy a home she replied,

“I am in love with the town of West Hartford, but the taxes are very high, so I would say Manchester… that would be nice”

– So you would want to get out of the city?

“Oh definitely. I don;t think that they’re doing enough here. The city has changed a lot. My son just had a baby, so I want to give my grandson the opportunity to you know grow up in a better place. Living in the South End, even at Trinity area is not as bad as over here where I raised my son. So just for raising him and different exposure.”

Another interesting comment was made by one man who noted insurance rates. He mentioned that rates are lower outside of Hartford because the crime rate is high in Hartford. High levels of crime, although not a prevalent sentiment, could also be another reason why residents want to move elsewhere.