TABLE OF CONTENTS

- Interviews

- Hartford Community Loan Fund

- Neighborhood Revitalization Zones

- Northside Institutions Neighborhood Alliance

- Data

- Conclusion, Recommendations, and Future Questions

INTERVIEWS

-

HARTFORD COMMUNITY LOAN FUND (HCLF):

We spoke to a member of the Hartford Community Loan Fund (HCLF). The Hartford Community Loan fund aims to “provide and promote just and affordable financial services that benefit low-wealth residents of the communities we serve. HCLF helps our borrowers overcome barriers—such as credit history, language, cultural differences, financial literacy, or lack of economic assets–that can isolate people from the financial mainstream.” 1 It was explained to us that homeowners loan from a traditional bank a buyer typically needs a credit score of around 640. This can be limiting for potential buyers from lower-income areas as many do not have credit or have not been able to have reliable access to traditional financial and banking institutions. In the North End, 10% of adults have no credit and 55% have credit scores under the 640 benchmark. This is where the HCLF fund comes in. During the interview, it was explained to us that in addition to making loans to atypical buyers the HCLF also assists in financing rehabilitation projects of outdated housing stock in the North End to convert these properties into mixed-income housing. Mixed-income housing is where there are a set number of units dedicated to affordable housing and then a set number to be sold at market rate. HCLF aims to assist in the redevelopment of owner-occupied housing in Hartford. Investing in owner-occupied housing creates opportunities for wealth creation through having landlords. However, being a landlord in a lower-income area or a first-time/accidental landlord comes with many challenges. Such as the individual cost to rehab homes or overall management of the properties. Hartford also has an absentee landlord problem. Properties with absentee landlords are often in disrepair and have lower renter standards. However, the member of the HCLF told us about some organizations that are working with the HCLF to address these problems such as the Southeastern Connecticut Community Land Trust (SC CT CLT). The SC CT CLT is a “nonprofit charitable organization that holds land for the development and stewardship of permanently affordable housing, land for food production, green space, and facilities for community organizations. SE CT CLT works to support access to affordable homeownership, advance community development, promote social justice, and further neighborhood revitalization across Southeastern Connecticut.” 2 Using this trust, Rex and his organization have been able to preserve and redevelop many homes in the North End. Additionally, the HCLF is using the state historic preservation office to access building tax breaks and credit programs for rehabbing and maintaining the integrity of historical homes. Rex says this program is underutilized and could be a great resource for helping lower-income buyers achieve homeownership and assist landlords in making repairs on their properties at a lower cost. One of HCLF’s goals is to help desegregate housing in Hartford and the surrounding areas. The Center for Community Progress is assisting the HCLF in this work by providing transportation and vehicles for renters living outside the city in the suburbs. This allows people to explore more affordable housing options outside the city and helps diversify the suburbs while giving lower-income families access to better school systems and higher-quality housing. The Local Initiatives Support Corporation (or LISC) is also assisting in financing new housing projects in Hartford that support the HCLF in this mission. LISC has helped finance some mixed-income units in the area recently in an effort to create some income diversification in the area.

-

NRZ (Neighborhood Revitalization Zones) :

We spoke to the NRZ presidents from Blue Hills and Upper Albany about their communities. The NRZ helps to create a space for residents to express their needs and concerns in monthly meetings. The NRZ board relays this information to people in official positions in order to get funding and resources. The NRZ presidents we spoke to wanted to activate their communities and encourage community activism. They work on projects of reinvestment, development, and community resources to best help their communities. We spoke about the importance of community activism and involvement and the effects it has. Both NRZ presidents gave examples of how cleaning the community and actively introducing a feeling of ownership increases the overall appearance of the community. Through the NRZ meetings, community members are able to feel that their concerns are heard. Feeling ownership and belonging to a community has a great effect on how one treats their living environment. The president of the Blue Hills NRZ told us about their initiative to reduce litter in the streets and how now residents will get upset when illegal dumping happens by non-community members. By speaking to the NRZ presidents from Blue Hills and Upper Albany we learned the main differences between Blue Hills and Upper Albany are homeownership levels and housing type. Blue Hills is mostly single-family owner-occupied housing. Whereas, Upper Albany is mostly multi-unit housing. The NRZ president for Blue Hills explained that they think the type of housing and ownership levels lend to a tighter knit, active, and long-lasting community. When we spoke to the NRZ president for Upper Albany and asked her about homeownership rates possibly increasing they stated that:

“I think with the progress of all of this is really going to in the things that are being put into place in the NRZ, it’s really going to show homeowners and residents that, there is hope to make this the street, the calm, peaceful, grassy parks, (and) nice area that we want it to be. We just have to work together. And we have to do it in a way that’s strategic and collaborative. And I think the NRZ is really helping with that. So that’s gonna allow a lot more people to have the confidence to stay and stay in the neighborhood.”

-

NINA (NORTHSIDE INSTITUTIONS NEIGHBORHOOD ALLIANCE) :

We spoke to a member of the Northside Institutions Neighborhood Alliance or NINA as it’s called. NINA predominantly serves the Asylum Hill neighborhood in Hartford, CT. Asylum Hill used to be known as “Lords Hill” during the golden age of industry in Hartford. Many factory owners and prominent businessmen built or owned houses on Asylum Hill creating a unique housing stock in the area. Later, these large homes were turned into multi-room boarding houses for factory workers. Eventually due to the difficulty of upkeeping such properties, many of these houses fell into disarray. During our interview, we learned about how NINA is rehabbing these historic homes to increase community homeownership rates and ensure that the history is not lost. NINA aims to revive Northside homes and places an emphasis on the exterior of the home they work on. It was explained to us that NINA focuses on the exterior because ensuring the outside of the home looks a certain way builds neighborhood solidarity and pride and incentivizes other homeowners to revitalize their homes as well. By bringing homes on Asylum Hill back to their prime, NINA is raising home values in the area. Through using historical building tax breaks and homeowner assistance programs they are able to sell the rehabbed homes to many first-time Hartford buyers. While most of the homes NINA buys and restores are single-family homes they also have handled a few multi-family properties. Multi-family homes have owner-occupancy clauses in their sale agreements to ensure that these projects are building wealth for homeowners and the community, not just generating landlords. Additionally, NINA works with community partners such as Hartford Hospital to acquire properties at lower costs. NINA has been successful overall in their work as all of their homes have been sold and either still have the original owner living there or have been resold for a profit to the original buyer. Similar programs to NINA exist such as its counterpart in New Haven, however NINA is one of the only programs that focuses specifically on historical preservation. The team at NINA are doing important work in increasing community ownership efforts in Hartford.

-

DATA :

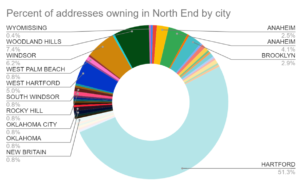

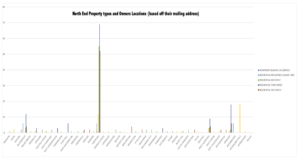

As part of our final product, we created a database for LISC. This database included information on housing, homeownership, and the residence of landlords. The chart and graph below is created from that database.

-

Conclusion, Recommendations, and Future Questions

There are many factors that affect the homeownership rate of a community. These factors include credit score, housing stock, multiunit housing, mortgage rates, and accessibility of assistance programs. Homeownership has a great impact on a community. This can be seen in the difference between Blue Hills and Asylum Hill which we learned through our interview with the NRZ presidents. An increased rate of homeownership helps form community bonds, increase communal stability and wealth, and create more active community members because of a sense of community ownership. These factors lead to a cleaner and more open street environment and will increase the resources available to the community.

There are already resources available in the North End to help community members achieve homeownership. Some of these include NINA and the Hartford Community Loan Fund, which we spoke to members during interviews. Data shows that the history of the North End greatly affects the housing stock and visibility of the North End. In order to create awareness and build the community action must take place and organizations like the NRZ have been instrumental in this.

The hypothesis is that by increasing homeownership in the North End that the community bond will become stronger thus increasing the overall wealth and opportunity in the area.

Future Research Questions

- The Open Community Alliance collected data regarding the opportunity index in Connecticut by zip code and learned that living in a certain zip code increased or decreased your opportunity, which wasn’t necessarily related to homeownership in the area. What might be other factors besides homeownership that impact a person’s opportunity?

- How has the NZR made an impact on the Hartford community? What do different communities in Hartford like/dislike about their NZR? How is each NRZ different/similar? Are certain NRZs more effective and if so how?